SMCI Stock Price Target: Comprehensive Analysis and Future Predictions

1. Introduction

Investing in stocks often involves stock price target predicting the future performance of a company’s shares based on its market position, performance, and industry trends. When it comes to Super Micro Computer, Inc. (SMCI), a prominent player in the high-performance computing and data center solutions market, understanding the stock price target becomes a crucial part of the investment process. For investors looking to take a position in SMCI, knowing its stock price target allows them to make informed decisions regarding their investments, be it short-term or long-term.

In this article, we will provide an in-depth analysis of SMCI’s stock price target. We’ll look at key factors that influence its price, provide short-term and long-term forecasts, and explore potential risks and considerations. Whether you’re an experienced investor or someone looking to understand the stock better, this article aims to equip you with everything you need to know about SMCI’s stock price target.

2. Understanding SMCI’s Market Position

Company Background and Industry Overview

Super Micro Computer, Inc. is a well-established company that provides high-performance computing solutions for a variety of sectors, including cloud computing, data centers, artificial intelligence (AI), and enterprise IT infrastructure. With a reputation for delivering customized and energy-efficient solutions, SMCI has built a solid foothold in the tech industry.

In recent years, SMCI has capitalized on the increasing demand for cloud computing services and the rapidly expanding data center market. As organizations shift toward digitalization and AI-driven operations, companies like SMCI play a critical role in ensuring that the infrastructure supporting these innovations is robust, scalable, and efficient. SMCI offers a wide range of products, from servers to storage systems, aimed at addressing the growing needs of businesses worldwide.

SMCI’s Role in the Tech Industry

SMCI has managed to carve out a niche in the market by focusing on providing products that are not only high in performance but also designed with energy efficiency in mind. This has made the company a preferred choice for large-scale enterprises that require reliable systems with low total cost of ownership. The company’s ability to offer customizable solutions sets it apart from competitors in the same industry, like Dell Technologies and Hewlett Packard Enterprise (HPE).

Additionally, SMCI has capitalized on the growing importance of AI and machine learning by developing advanced server systems designed for AI workloads. With the ever-increasing demand for AI capabilities in industries such as healthcare, finance, and retail, SMCI is well-positioned to grow as AI applications continue to gain traction.

3. Factors Affecting SMCI Stock Price

Industry Trends

One of the most significant factors influencing SMCI’s stock price is the growth of the tech and cloud computing industry. As businesses and consumers alike increasingly rely on cloud-based solutions, the demand for data centers and high-performance computing infrastructure is at an all-time high. This demand bodes well for SMCI’s core business.

Technological advancements also play a crucial role. The continued evolution of data processing, the rise of AI, and the expansion of the Internet of Things (IoT) are pushing the limits of what infrastructure systems need to support. As SMCI continues to innovate, it could become an even more prominent player in providing the hardware solutions needed to support these advanced technologies.

Company Performance

The financial performance of SMCI is another key determinant of its stock price. Over the years, the company has demonstrated consistent revenue growth, driven by its product diversification and global expansion efforts. With impressive profit margins and a strong market share in the enterprise IT space, investors look closely at the company’s earnings reports and financial health.

Key product launches, strategic partnerships, and acquisitions also impact SMCI’s stock price. For instance, when SMCI enters new markets or announces major collaborations, such as its recent ventures into the AI and machine learning sectors, it typically sees a boost in investor confidence, which can positively influence its stock price.

Economic and Market Conditions

Like most stocks, SMCI’s price is also impacted by broader market conditions. Economic factors such as inflation, interest rates, and geopolitical events can significantly affect investor sentiment. If the market is experiencing volatility or uncertainty, even fundamentally strong companies like SMCI might see their stock price fluctuate. In times of economic downturn, investor appetite for stocks can wane, leading to price adjustments.

Additionally, the overall tech sector’s performance can have a direct impact on SMCI. If major indices such as the Nasdaq perform well, companies in the tech sector typically follow suit. On the other hand, a downturn in tech stocks, often driven by external macroeconomic factors, can lead to a decline in SMCI’s stock price.

Analyst Opinions and Stock Ratings

Stock analysts play a key role in determining a stock’s price target. Based on their research and understanding of market dynamics, analysts provide buy, sell, or hold ratings for stocks. For SMCI, a combination of strong financial performance and market trends has led many analysts to maintain a positive outlook on the stock.

Analyst price targets for SMCI vary, but most agree that the stock has significant growth potential in the coming years. Depending on the analyst, the short-term stock price target can range between $200 and $250, while long-term projections push the target into the $300 to $350 range. As SMCI continues to innovate and expand, these targets could shift, reflecting the company’s performance.

4. Analyzing SMCI’s Stock Price Target

Current Stock Price Overview

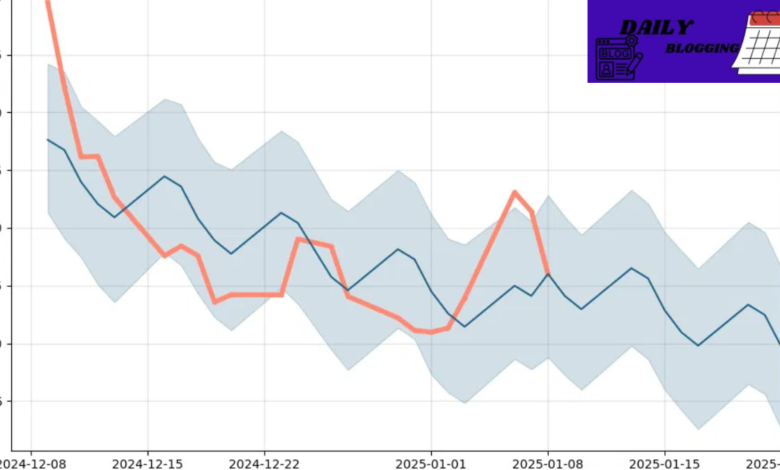

As of the latest data, SMCI’s stock price is hovering around $210 per share. The stock has shown a strong upward trend over the past year, primarily driven by investor optimism surrounding the tech sector’s growth and SMCI’s increasing role in the AI and data center industries. However, like any stock, SMCI is not immune to volatility, and its price can fluctuate depending on broader market trends and company-specific developments.

Short-Term Price Forecast (6-12 months)

In the short term, SMCI’s stock is expected to experience moderate growth. Analysts predict that the stock price will likely stay within a range of $210 to $240 per share over the next 6 to 12 months. Key factors influencing this projection include the company’s upcoming product releases, its quarterly earnings reports, and developments in the AI and cloud computing markets.

Additionally, the broader market sentiment and the performance of tech stocks will continue to play a critical role in short-term price movements. Positive news regarding SMCI’s strategic partnerships, client acquisitions, or product innovations could push the stock price towards the higher end of the forecast range.

Long-Term Price Forecast (1-5 years)

Looking ahead, SMCI’s stock has significant growth potential. As demand for AI solutions and cloud computing infrastructure continues to rise, the company is well-positioned to capture more market share. In the next 1 to 5 years, analysts predict that SMCI’s stock price could reach anywhere between $300 and $350 per share, assuming the company continues its upward trajectory and stays competitive in the evolving tech landscape.

The long-term growth of SMCI depends largely on the company’s ability to innovate and expand its reach in emerging markets, including AI, machine learning, and edge computing. If SMCI continues to outperform in these areas, the stock price may see accelerated growth, attracting long-term investors.

5. Risk Factors and Considerations

While SMCI’s stock offers promising growth potential, there are several risk factors that investors should consider. Volatility remains a significant concern, as the tech sector is known for its cyclical nature. Market downturns, changes in investor sentiment, or unforeseen economic factors can cause significant price fluctuations.

Regulatory changes, supply chain disruptions, or increased competition from other tech giants could also impact SMCI’s profitability. Additionally, the company’s reliance on global markets makes it susceptible to geopolitical tensions or trade policy changes, which could negatively affect its operations.

6. Conclusion

In conclusion, SMCI’s stock shows a promising future driven by solid fundamentals, industry growth, and innovation in key areas such as AI and data centers. Short-term predictions suggest moderate growth, while long-term forecasts point toward significant upside potential. However, as with any stock, risks such as market volatility and economic factors must be considered.

For investors looking to enter the SMCI market, the stock presents a potential opportunity, but it is essential to weigh the risks carefully. With a balanced perspective and informed decision-making, investors can make the most out of their investments in SMCI.

7. Frequently Asked Questions (FAQs)

1. What is SMCI’s current stock price target?

The current stock price target for SMCI is estimated to range from $210 to $250 for the short term (6-12 months), with long-term projections reaching $300 to $350.

2. How do analysts arrive at a stock price target for SMCI?

Analysts use various factors, including company financials, market trends, industry outlook, and technical analysis to determine a stock’s target price.

3. Is SMCI a good long-term investment?

Given its growth prospects in AI, cloud computing, and data centers, SMCI is considered a strong long-term investment by many analysts, with expectations for future stock price increases.

4. What factors should investors consider when setting a price target for SMCI?

Investors should consider the company’s earnings reports, industry trends, competitive advantages, and broader economic conditions when setting a price target.

5. What are the risks of investing in SMCI stock?

The risks include market volatility, economic downturns, supply chain issues, and increased competition.

6. How do macroeconomic factors affect SMCI’s stock price?

Macroeconomic factors like inflation, interest rates, and geopolitical events can influence investor sentiment and overall market performance, impacting SMCI’s stock price.

7. Has SMCI’s stock price been volatile in the past?

Yes, like many tech stocks, SMCI has experienced price volatility, especially during market downturns or following major industry shifts.

8. How can I track SMCI’s stock price target updates?

You can track SMCI’s stock price target updates through financial news websites, brokerage platforms, and analyst reports.